In the 21st century, just about everything has morphed into an interactive, hyper-social, customer-centric experience.

Everything except finance.

After 27 years in banking, BJ McAndrews knows this as well as anyone. Over the years, McAndrews began to watch the emergent fintech space and watched large, traditional financial institutions falling behind to quicker, more agile tech firms. However, while apps like Strava turned fitness into a socially connected experience and Spotify personalized the process of musical discovery, finance remained, in his words, a “laggard.” His frustration with the slow pace of play of a big bank led him to leave his role at Wells Fargo in 2019 and begin the planning for a mobile banking solution to help close the wealth gap in America.

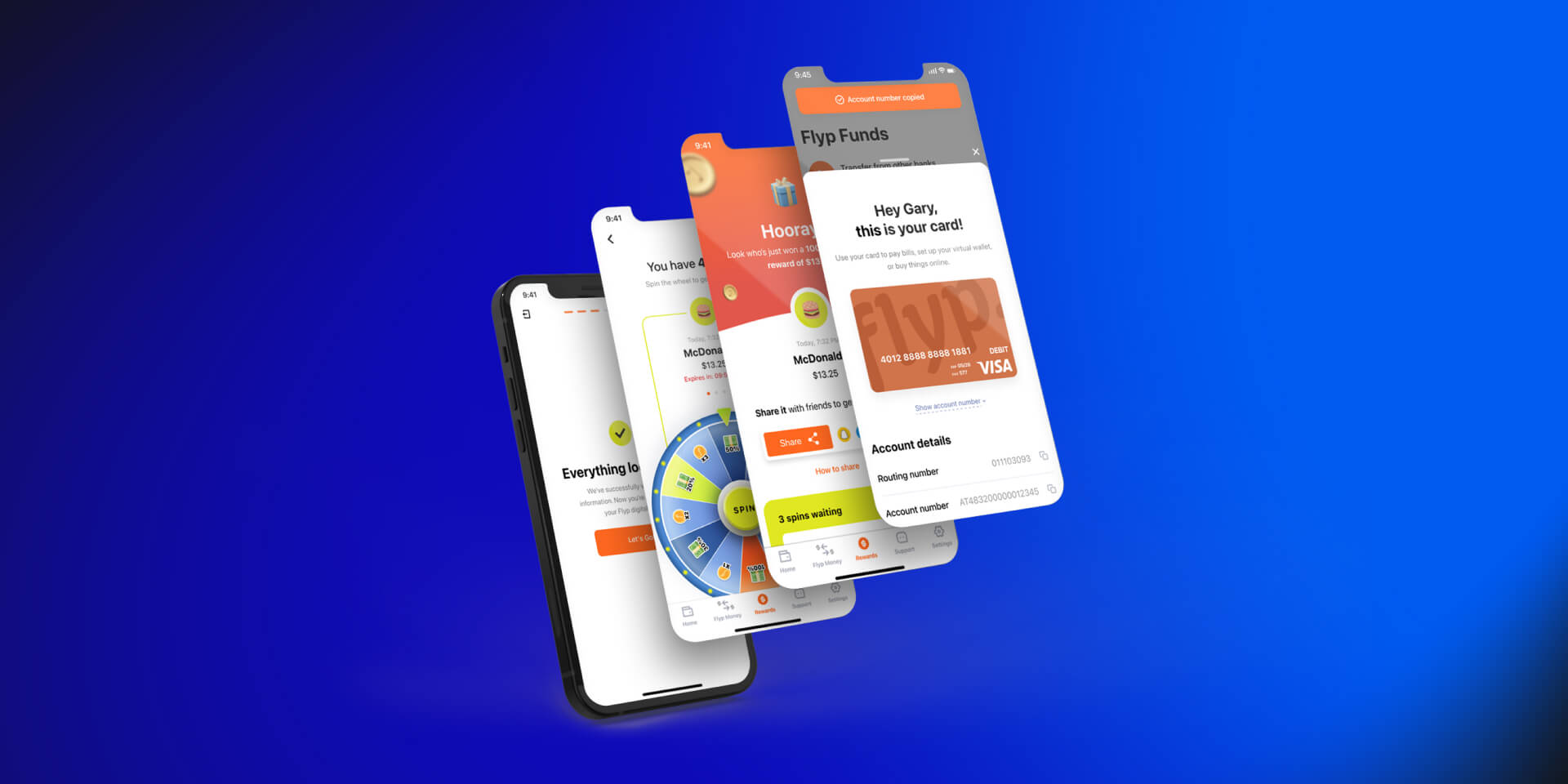

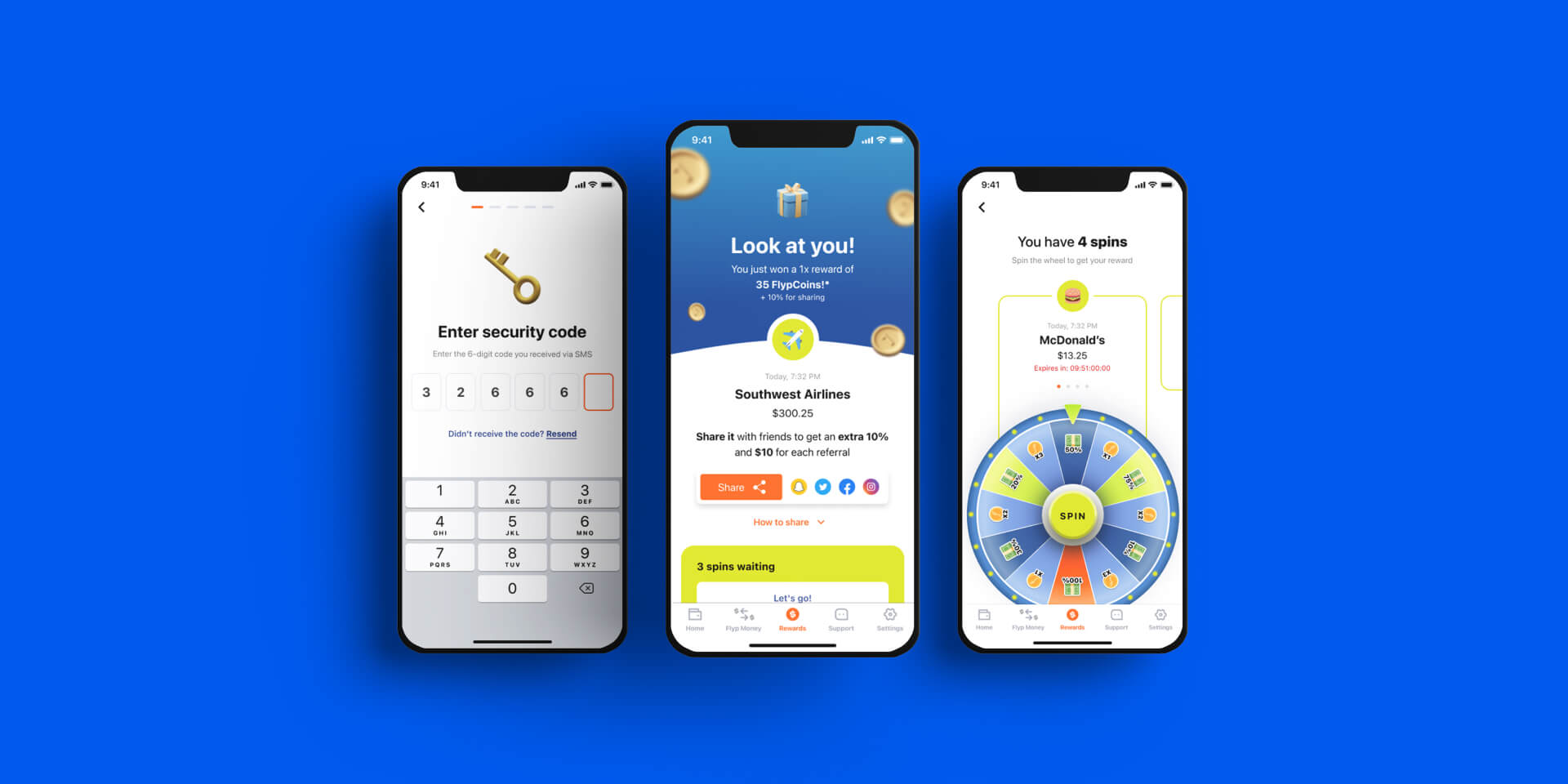

In early 2020, McAndrews partnered with long-time friend and tech entrepreneur Gary Zukowski. Their vision: to create the first social network for finance. McAndrews brought the “fin;” Zukowski brought the “tech.” Together, they hatched a consumer fintech neobank called Flyp, a mobile banking application that would “flip the script” on traditional banking, making it accessible, affordable and fun.

When we decided to leverage banking as a service (BaaS), there were essentially 11 major pieces of the puzzle we needed to assemble, the most important being a partner bank, a payment rail provider and a processor. We also needed KYC/AML security, a direct deposit solution and an elegant, contextual user experience for our customers.

B.J. McAndrews

Co-Founder and CEO

The build of the initial MVP was critical to their success. They needed a development partner who could not only build the application but also navigate the slew of integrations that were required. Enter Dualboot Partners.

The opportunity

For McAndrews and Zukowski, the core mission in building Flyp was to narrow the wealth gap in the U.S.

There are roughly 60 to 70 million Americans who don’t fit into the traditional financial system. Some can’t afford to bank at the big banks. Some don’t trust the institutions themselves. And some, particularly younger generations, have simply become accustomed to better user experiences. They’re looking for something beyond the status quo.

“Those are the people we’re going after,” McAndrews said. “We are a consumer technology company that lays on top of a bank, so it’s a very modern way to offer finances to people with a great user experience.”

Flyp solves key customer pain points by offering a modern interface, early direct deposit, no hidden fees and a gamified reward experience, which will enhance customer acquisition, customer engagement and customer retention. They also plan on gamifying financial education through challenges, quests and rewards.

To bring Flyp to life, the team secured a partnership with Sutton Bank, an issuing bank that has partnered with some of the biggest fintech companies in the market, including Cash App and Robinhood. They also signed with Visa, who embraced Flyp’s vision and has a very strong fintech presence.

With those key relationships in place, it was time to determine how they would build the Flyp MVP app: build a DevOps team in-house or outsource to a third-party provider?

“We white-boarded both options, and outsourcing was the best one for us, in part because hiring an effective, cohesive development team would take longer than we had time for, at least for our initial launch,” McAndrews said.

In search of the right development partner, McAndrews and Zukowski considered multiple vendors all over the world. Then, their law firm, Morris, Manning and Martin LLP, recommended Dualboot Partners. In addition, Zukowski had leveraged the Dualboot team on a previous startup and had great results. They also discovered that Dualboot had worked on more than 20 fintech projects, which was a point in the firm’s favor. Still, they wanted to make sure Dualboot was the right partner.

“We must have had half dozen phone calls with Dualboot and drilled them with questions about how they would build it and how they would scale it,” McAndrews said. “I went out to lunch with Todd (Buelow, Dualboot Partners co-founder), and I said, ‘No BS, can you do this?’ He smiled and said, ‘Yeah, we can do this.’”

The solution

The project was not without its potential challenges. One of the most complex aspects of the Flyp build was the integrations it required, particularly with its processor, Galileo Financial Technologies, which has a robust API set.

“They are our system of record, our ledger. Every important piece of information that’s moving around our system is touching Galileo,” McAndrews said.

It was a vital aspect of the Flyp application and, as Galileo explained to McAndrews, one that required a dev partner that understood the complexities of integration. Dualboot had vast experience in fintech integrations but was new to Galileo.

But Dualboot adapted to the technical requirements Galileo presented, McAndrews said, adding team members to the project and digging in to ensure the integration took shape seamlessly. In the end, the integration was a complete success. Now, as Galileo advises new clients, Dualboot has become a name it trusts. Recently, McAndrews spoke with a company that was considering an integration with Galileo. When the company asked Galileo for dev firm recommendations, the processor referred Dualboot Partners as one of its primary partners.

The impact

Flyp entered beta in December 2021 with friends, family and some investors and has attracted 20,000 people to its waitlist who are ready to sign up when it launches, which should be in January 2022.

“There are just so many intricacies with banking as a service. Any time you’re dealing with people’s money and federal regulations, you want to make sure everything is working properly,” McAndrews said. “I understand consumer risk and interest rate risk and underwriting risk, but when it came down to the technology, I had to rely on Gary, a lot, and I had to rely on and trust Dualboot, a lot.”

Flyp’s goal is to iterate beyond their MVP and build upon the strong foundation that Dualboot has architected. Eventually, Flyp will become the first social network for finance, complete with a financial education program to address another key pain point in the industry: People don’t know enough about their money, and schools just don’t teach it.

I laugh when people say fintech is crowded. The innovation we are going to see will be mind blowing, and there are going to be a lot of winners. We are creating something that is really different in this space, attracting a loyal community of customers and will continue to build products and services that delight them.

B.J. McAndrews

Co-Founder & CEO