In the 21st century, just about everything has morphed into an interactive, hyper-social, customer-centric experience.

Everything except finance.

After 27 years in banking, BJ McAndrews knows this as well as anyone. Over the years, McAndrews began to watch the emergent fintech space and watched large, traditional financial institutions falling behind to quicker, more agile tech firms. However, while apps like Strava turned fitness into a socially connected experience and Spotify personalized the process of musical discovery, finance remained, in his words, a “laggard.” His frustration with the slow pace of play of a big bank led him to leave his role at Wells Fargo in 2019 and begin the planning for a mobile banking solution to help close the wealth gap in America.

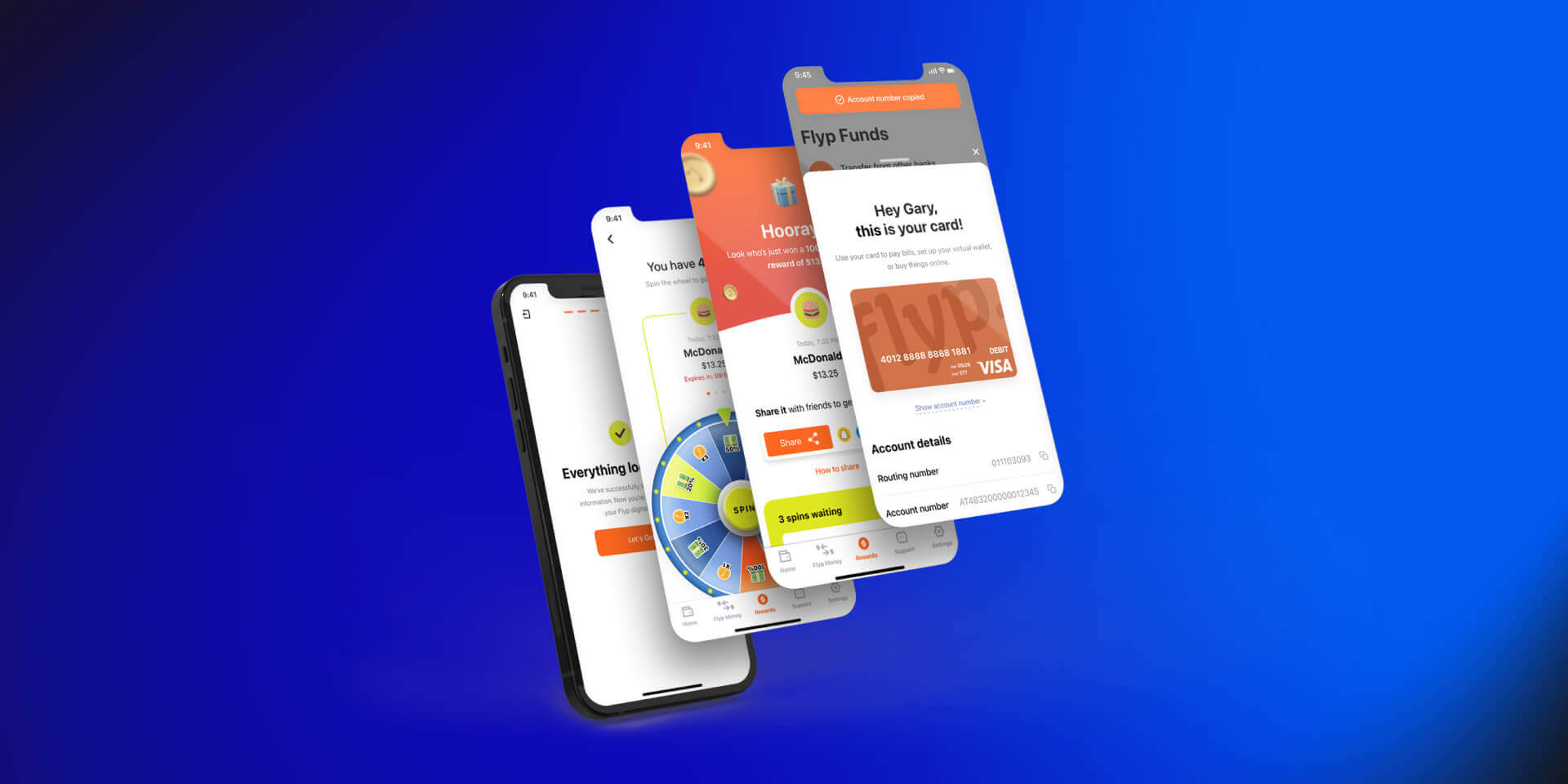

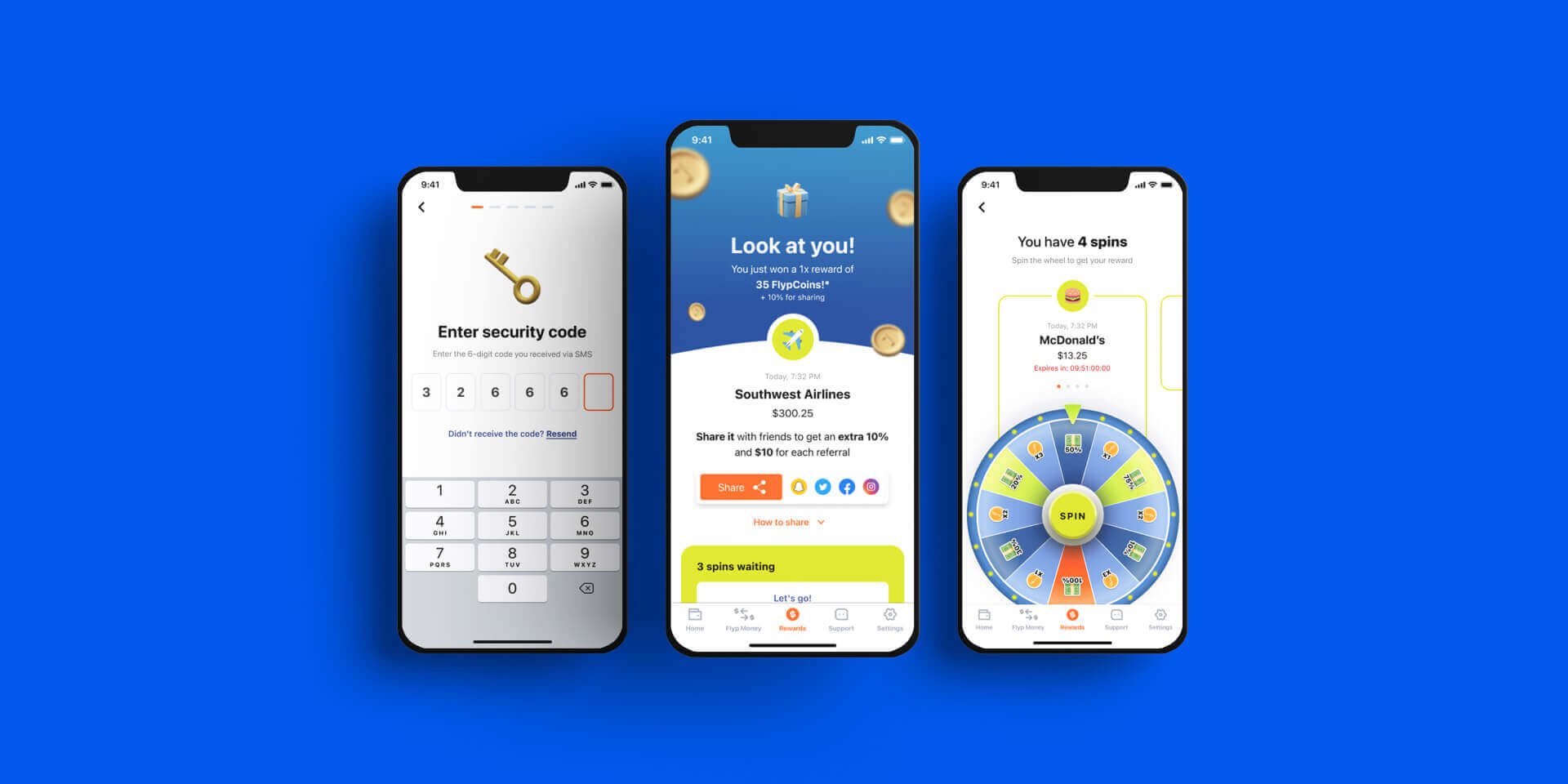

In early 2020, McAndrews partnered with long-time friend and tech entrepreneur Gary Zukowski. Their vision: to create the first social network for finance. McAndrews brought the “fin;” Zukowski brought the “tech.” Together, they hatched a consumer fintech neobank called Flyp, a mobile banking application that would “flip the script” on traditional banking, making it accessible, affordable and fun.

The build of the initial MVP was critical to their success. They needed a development partner who could not only build the application but also navigate the slew of integrations that were required. Enter Dualboot Partners.